Retirement Planner helps you determine how much money you will need for your retirement to maintain the current lifestyle post retirement. You can give the ... Read More > or Download Now >

Retirement Planner for Windows Phone

Tech Specs

- • Version: 3.0.0.0

- • Price: 0

- • Content Rating: Not Rated

- • Requirements: Windows Phone 8.1, Windows Phone 8

- • File Name: Retirement-Planner.XAP

User Ratings

- • Rating Average:

- 5 out of 5

- • Rating Users:

- 2

Download Count

- • Total Downloads:

- 2

- • Current Version Downloads:

- 2

- • Updated: June 17, 2016

More About Retirement Planner

Features

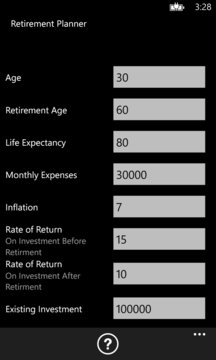

- Fields for Current Age, Retirement Age, Life Expectancy, Monthly Expenses, Inflation, Rate of Return on investment Before Retirement & After Retirement, Years to Retire, Yearly Expenses at retirement, Retirement Corpus, Monthly Investment

Age (Years) : 30

Retirement Age (Years) : 58

Monthly Expenses : 30,000

Inflation (%) : 7

Rate of Return (%) on investment Before Retirement : 15

Rate of Return (%) on investment After Retirement : 10

Year to Retire : 28

Monthly Expenses at retirement : 1, 99,465

Yearly Expenses at retirement : 23,93,582

Retirement Corpus : 3, 99, 98,132

Monthly Investment : 7,719

Example:

Suppose you are 30 years old who wants to retire at 58 and expect to live till 80.

If your current Monthly Household Expenses (excluding expenses which will not be part of it post Retirement e.g. EMI, Insurance Premium, Education Expenses etc) are 30000,

You expect inflation to be around 7% for next 28 years,

You expect 15% return on your investments before retirement and

During retirement you expect that your investments will return 10%.

So Number of Years left for your retirement are 28 years and at retirement you will require a retirement corpus of 3,99,98,132 for which I need to save 7,719 per month.